Our team would like to provide you with an update regarding the recent announcements regarding income tax filing and payment extensions.

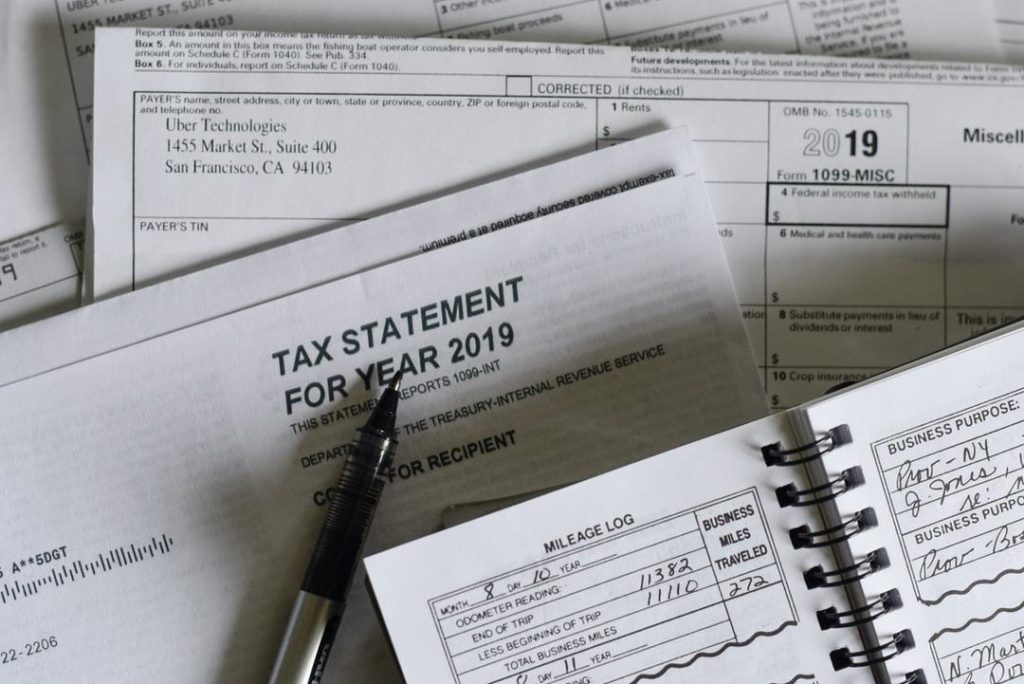

Coronavirus News: Income Tax Filing and Payment Deadlines Extended

The new filing and payment deadline for IRS and California is now automatically July 15th. So, no taxpayer needs to file or make any payments until July 15th. There will be no interest charges or penalties to delay any payment of income taxes (up to $1 million) up until July 15th.

However, you can complete your tax returns and file them at any time prior to July 15th. If you file prior to July 15th, any money you owe for 2019 taxes or 2020 estimated payments can be paid by July 15th upon your specific request to your tax preparer or as an input to your tax software. Otherwise, payments will be made on the usual due dates once you file.

California is in alignment with the extended federal filing guidelines. Most other states will likely conform to IRS guidelines as well.

In addition, the deadline for 2019 Health Savings Account, IRA, Roth IRA, and retirement plan contributions has been extended to July 15th.

Wade Financial Advisory, Inc. is currently operating as an “Essential Business” with some staff in the office and others working from home.

Protect Your Wealth in Silicon Valley

We welcome the opportunity to answer any questions you may have. Contact us to learn more about how WFA can partner with you to grow and protect your wealth.