We would like to provide you with a brief update to share our thoughts on the coronavirus and its impact for investors.

Coronavirus News: Coronavirus, Investment Management, and the Stock Market

- The recent outbreak of coronavirus has spread to additional countries, and policies to contain the spread of the disease will include keeping people in their home or region, reducing travel, work, and consumer spending.

- The policies above have led to a dampening in expectations for the pace of global economic growth for 2020, and a reduction in expectations for earnings growth for global companies.

- The global stock market has declined ~12%, reflecting the impact of less robust economic growth and earnings in stock prices.

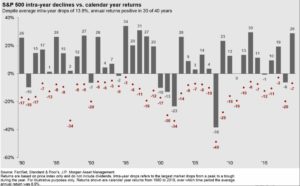

- Stock market declines of 10% or more, referred to as a “correction” occur every two years on average, as illustrated by the red dots in the chart below (versus the grey bars indicating the generally positive full-year returns). While these occasions can be unsettling at the moment, they are a constant element of stock market investing.

- We believe taking consistent action in accordance with a long-term plan is the most effective method to grow the portfolio in the long run. Your portfolio is designed to achieve your long-term goals, and we will continue to manage your investments in a manner consistent with your portfolio’s risk and return characteristics.

- Actions that we perform on an ongoing basis include monitoring portfolios for opportunities to generate tax benefits through loss-harvesting, and rebalancing the portfolio back to its intended composition where warranted.

Protect Your Wealth in the Bay Area

We welcome the opportunity to answer any questions you may have. Contact us to learn more about how WFA can partner with you to grow and protect your wealth.