2024 1st Quarter Investment Review and Portfolio Changes

In our quarterly investment update, we’d like to:

- Summarize market activity over the 1st quarter of 2024

- Review the impact of elections on markets

- Share information on March dividends in Schwab accounts

- Provide various market returns information

Market Summary for the 1st Quarter of 2024

In the 1st quarter, the global stock market delivered a ~8% return, as stock markets continued their recovery from the declines of 2022, and reached new highs largely driven by investor optimism on the potential for corporate earnings growth and economic growth data that has remained robust despite high interest rates. The S&P 500 increased ~10%, primarily driven by an increase of ~7% in the price investors are willing to pay per dollar of earnings, and a ~3% increase in corporate earnings over the prior quarter.

Valuations for US stocks, as measured by the ratio of stock price to earnings (P/E) remain above their long-term average, and the earnings yield (earnings divided by stock price) for the S&P 500 is currently below the yield on 10-year Treasury debt.

The US bond index declined ~1% as investors became slightly less optimistic about the potential for interest rate cuts, as declining interest rates would drive an increase in prices for existing bonds. The potential for declining interest rates is largely driven by the level of inflation, which the Federal Reserve seeks to influence by keeping borrowing costs elevated, as a tool to reduce spending by businesses and individuals.

The Consumer Price Index (CPI) at the end of the quarter reflected a ~3.5% rate of inflation over prices a year ago. Although inflation has moderated in comparison to the high levels experience beginning in 2020, inflation remains above the Federal Reserve’s longer-term 2% target.

While the Federal Reserve seeks to contain inflation, they also look to support a high level of employment for workers. As data on employment and economic growth continues to be strong, the Federal Reserve may feel empowered to maintain higher interest rates instead of perceiving a need to reduce interest rates to avoid excessive job losses.

As inflation continues on a slowly moderating path, some components of inflation remain elevated, such as housing costs and car insurance (driven by the increasing repair costs of high-tech cars). The price of services remains a challenging component of inflation, as wages paid to workers continue to grow in a tight labor market that favors workers.

How Elections Impact Your Portfolio

As we look ahead to elections later in the year, we’d like to revisit how these events impact investors. While elections have great influence on American policy and society, the effect of elections on the stock market may be less pronounced than you might anticipate.

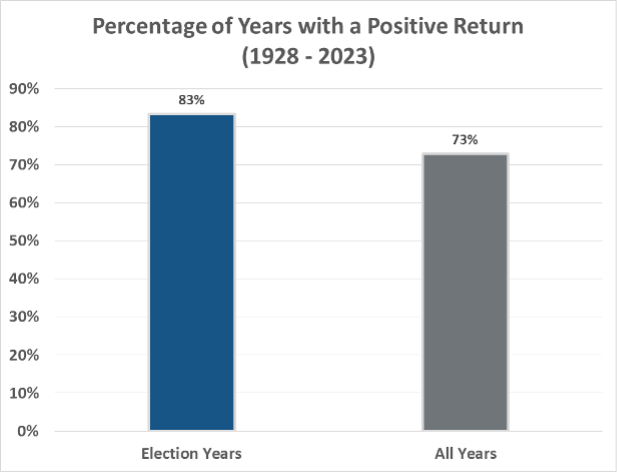

As shown in the chart below, since 1928, the return on the US stock market has risen in the majority of election years, despite the potential for voters to feel uncertain about the impact of election outcomes on their portfolios.

Data source: NYU Stern School of Business. US Stock Market returns based on blended index data for illustrative purposes. An index is theoretical and cannot be owned directly.

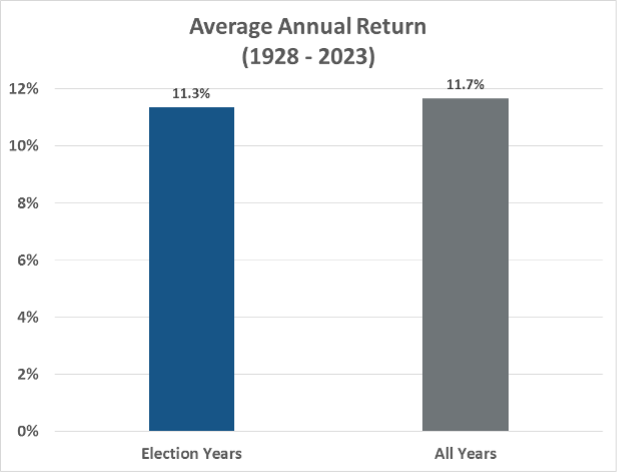

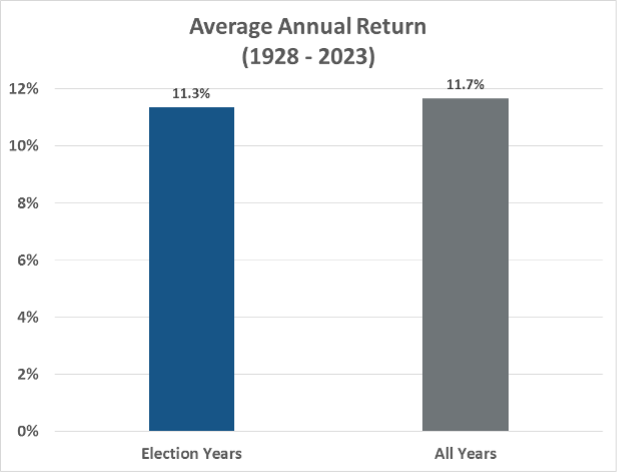

Additionally, the average return for an election year has been similar to the average return for any given year through the same period as shown below. This demonstrates the ability for companies in aggregate to participate in economic growth and effectively manage their business through the uncertainty of election years.

Data source: NYU Stern School of Business. US Stock Market returns based on blended index data for illustrative purposes. An index is theoretical and cannot be owned directly.

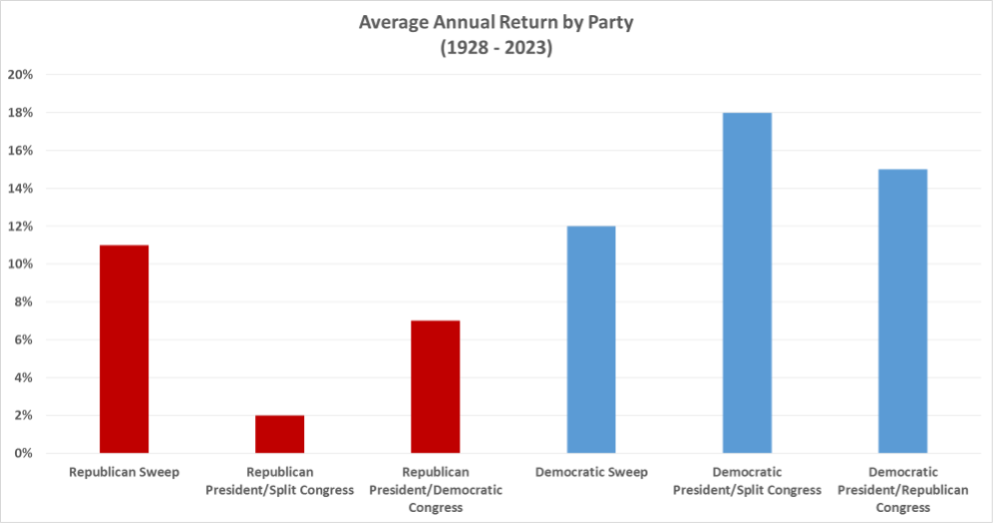

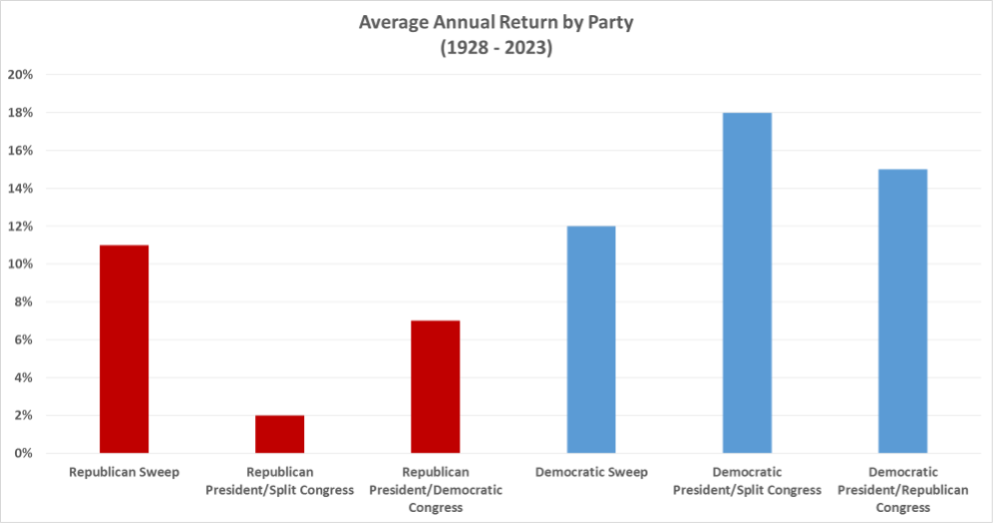

When looking at stock market returns categorized by the political party in office, we can see that stock markets generate positive returns regardless of the party in charge, as demonstrated by the chart below.

Data source: John Hancock Investments. For illustrative purposes only, an index is theoretical and cannot be owned directly.

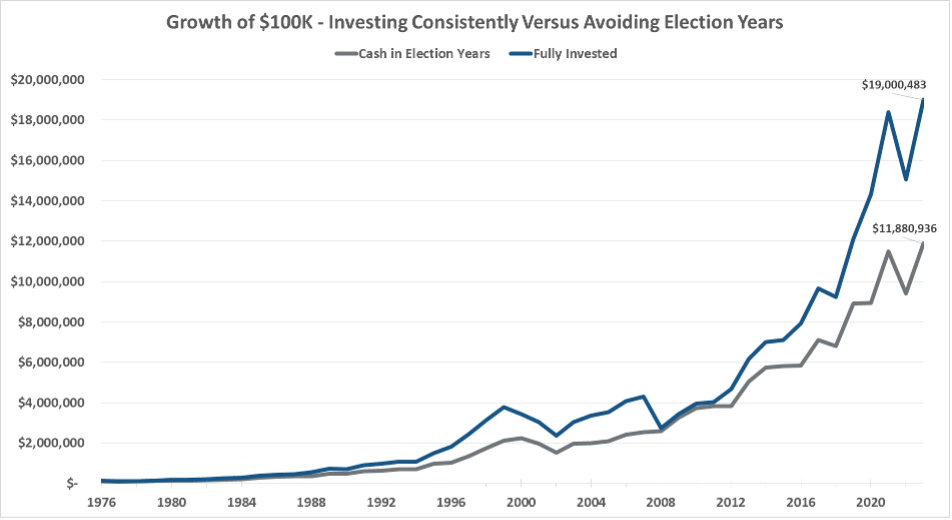

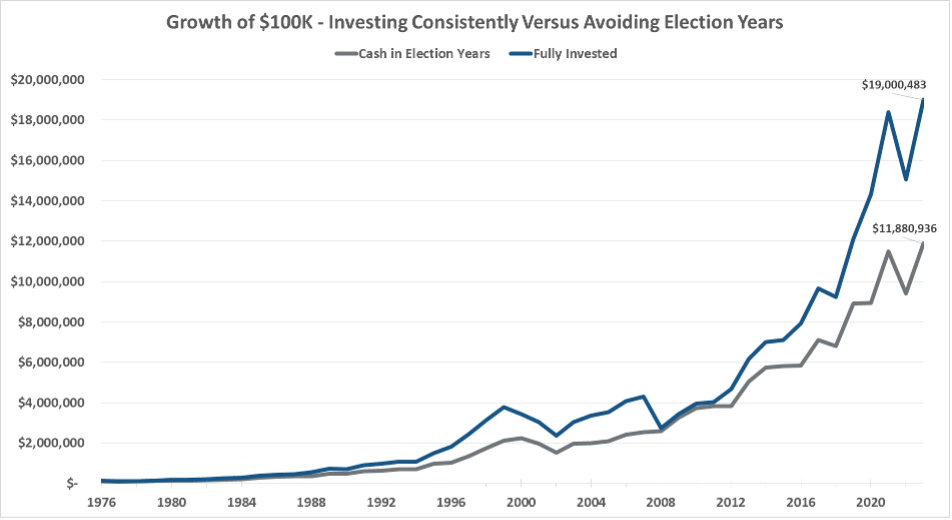

Lastly, we can compare investment outcomes for an investor who sold their stock market investments and held cash instead during election years, against the returns of an investor who remained consistently invested in the stock market. The illustration below covers 1976 through 2023, doesn’t incorporate any tax costs of selling investments, and uses the annual return on 3-month Treasury debt as a proxy for the return on cash.

By holding cash through election years, an investor stood to lose ~38% of their potential wealth over five decades, without considering any tax costs. We believe the best course of action is to remain consistently invested over the long term at a level of risk that you can maintain through periods of uncertainty and through good and bad market environments.

Data source: NYU Stern School of Business. US Stock Market returns based on blended index data for illustrative purposes. An index is theoretical and cannot be owned directly.

Information Regarding March Dividends in Schwab Accounts

For clients with accounts at Schwab and holding investments that paid dividends on March 28, Schwab processed payments on that date based on dividend amounts previously paid on February 29, rather than the intended amount. This issue was identified and corrected on March 29, with the corrected dividend value resulting in a slightly higher payment amount for most clients. Schwab has confirmed that accounts correctly reflect the intended dividend payments, and we have reviewed calculations for a number of dividend payments to verify that that is the case.

When reviewing your transactions on the Schwab website, or transaction notifications in your messages, you may see transactions titled “dividend adjustment” associated with the dates above, which reflect these adjustments. Please reach out to your team at WFA if you have any questions, and we’d be glad to address them.

Market Returns for the 1st Quarter of 2024

If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

2024 1st Quarter Investment Review and Portfolio Changes

Wade Financial Advisory

2024 1st Quarter Investment Review and Portfolio Changes

In our quarterly investment update, we’d like to:

Market Summary for the 1st Quarter of 2024

In the 1st quarter, the global stock market delivered a ~8% return, as stock markets continued their recovery from the declines of 2022, and reached new highs largely driven by investor optimism on the potential for corporate earnings growth and economic growth data that has remained robust despite high interest rates. The S&P 500 increased ~10%, primarily driven by an increase of ~7% in the price investors are willing to pay per dollar of earnings, and a ~3% increase in corporate earnings over the prior quarter.

Valuations for US stocks, as measured by the ratio of stock price to earnings (P/E) remain above their long-term average, and the earnings yield (earnings divided by stock price) for the S&P 500 is currently below the yield on 10-year Treasury debt.

The US bond index declined ~1% as investors became slightly less optimistic about the potential for interest rate cuts, as declining interest rates would drive an increase in prices for existing bonds. The potential for declining interest rates is largely driven by the level of inflation, which the Federal Reserve seeks to influence by keeping borrowing costs elevated, as a tool to reduce spending by businesses and individuals.

The Consumer Price Index (CPI) at the end of the quarter reflected a ~3.5% rate of inflation over prices a year ago. Although inflation has moderated in comparison to the high levels experience beginning in 2020, inflation remains above the Federal Reserve’s longer-term 2% target.

While the Federal Reserve seeks to contain inflation, they also look to support a high level of employment for workers. As data on employment and economic growth continues to be strong, the Federal Reserve may feel empowered to maintain higher interest rates instead of perceiving a need to reduce interest rates to avoid excessive job losses.

As inflation continues on a slowly moderating path, some components of inflation remain elevated, such as housing costs and car insurance (driven by the increasing repair costs of high-tech cars). The price of services remains a challenging component of inflation, as wages paid to workers continue to grow in a tight labor market that favors workers.

How Elections Impact Your Portfolio

As we look ahead to elections later in the year, we’d like to revisit how these events impact investors. While elections have great influence on American policy and society, the effect of elections on the stock market may be less pronounced than you might anticipate.

As shown in the chart below, since 1928, the return on the US stock market has risen in the majority of election years, despite the potential for voters to feel uncertain about the impact of election outcomes on their portfolios.

Data source: NYU Stern School of Business. US Stock Market returns based on blended index data for illustrative purposes. An index is theoretical and cannot be owned directly.

Additionally, the average return for an election year has been similar to the average return for any given year through the same period as shown below. This demonstrates the ability for companies in aggregate to participate in economic growth and effectively manage their business through the uncertainty of election years.

Data source: NYU Stern School of Business. US Stock Market returns based on blended index data for illustrative purposes. An index is theoretical and cannot be owned directly.

When looking at stock market returns categorized by the political party in office, we can see that stock markets generate positive returns regardless of the party in charge, as demonstrated by the chart below.

Data source: John Hancock Investments. For illustrative purposes only, an index is theoretical and cannot be owned directly.

Lastly, we can compare investment outcomes for an investor who sold their stock market investments and held cash instead during election years, against the returns of an investor who remained consistently invested in the stock market. The illustration below covers 1976 through 2023, doesn’t incorporate any tax costs of selling investments, and uses the annual return on 3-month Treasury debt as a proxy for the return on cash.

By holding cash through election years, an investor stood to lose ~38% of their potential wealth over five decades, without considering any tax costs. We believe the best course of action is to remain consistently invested over the long term at a level of risk that you can maintain through periods of uncertainty and through good and bad market environments.

Data source: NYU Stern School of Business. US Stock Market returns based on blended index data for illustrative purposes. An index is theoretical and cannot be owned directly.

Information Regarding March Dividends in Schwab Accounts

For clients with accounts at Schwab and holding investments that paid dividends on March 28, Schwab processed payments on that date based on dividend amounts previously paid on February 29, rather than the intended amount. This issue was identified and corrected on March 29, with the corrected dividend value resulting in a slightly higher payment amount for most clients. Schwab has confirmed that accounts correctly reflect the intended dividend payments, and we have reviewed calculations for a number of dividend payments to verify that that is the case.

When reviewing your transactions on the Schwab website, or transaction notifications in your messages, you may see transactions titled “dividend adjustment” associated with the dates above, which reflect these adjustments. Please reach out to your team at WFA if you have any questions, and we’d be glad to address them.

Market Returns for the 1st Quarter of 2024

If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment adviser registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wade Financial Advisory, Inc. at (408) 369-7399 with any questions.

Categories

More Articles

Family Foundations vs. Donor-Advised Funds: Choosing the Right Vehicle for Your Philanthropy

Equity Benefits Post-IPO in Tech

Tax Benefits of Philanthropy for High-Net-Worth Individuals

High-Income Family Guide to College Financial Planning

Understanding RSUs, Stock Options, and ESPPs: Insights for Tech Executives in Silicon Valley

Navigating Alternative Minimum Tax: Strategies for High Earners

There's no time like the present

Contact us today to speak to one of our trusted advisors and learn how our team can partner, educate, and guide you on your path to financial confidence.