As part of our ongoing approach to systematically managing portfolio risks, we periodically seek to rebalance portfolios by bringing the mix of stocks, bonds, and alternative investments in alignment with their targets by selling a portion of higher-performing assets and purchasing those that have not performed as well.

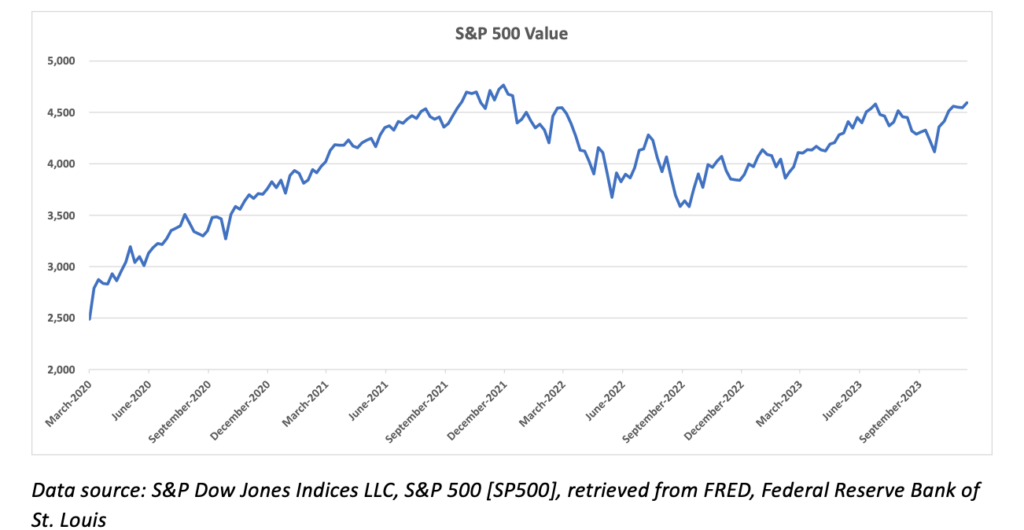

Given the growth of the stock market, as demonstrated by the chart of the S&P 500 below, stocks now represent a slightly higher proportion of client portfolios due to the increase in value of these investments.

Additionally, to take advantage of depressed stock market prices during the peak pandemic year of 2020, we slightly increased our targeted level of stock investment at that time by 2% for conservative portfolios with a low level of stock investment and up to 4% for growth-oriented portfolios with a higher level of stock investment.

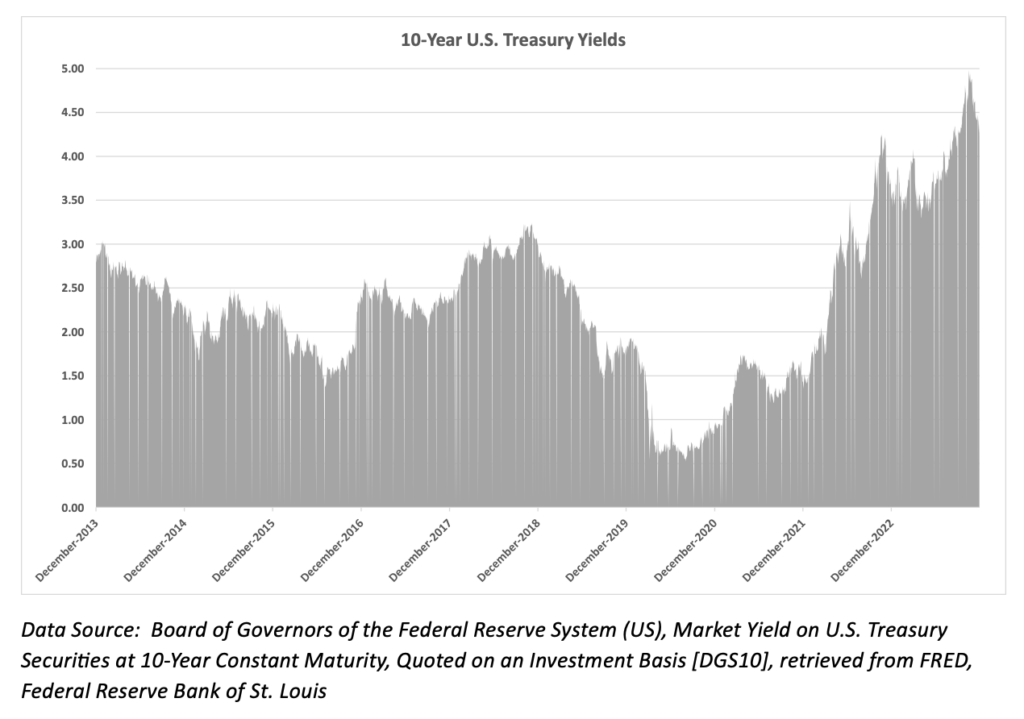

Since that time, stocks have grown slightly more expensive in comparison to bonds, as yields on U.S. Treasury investments have increased over the past several years (as yields move up, bond prices move down), as shown in the chart below.

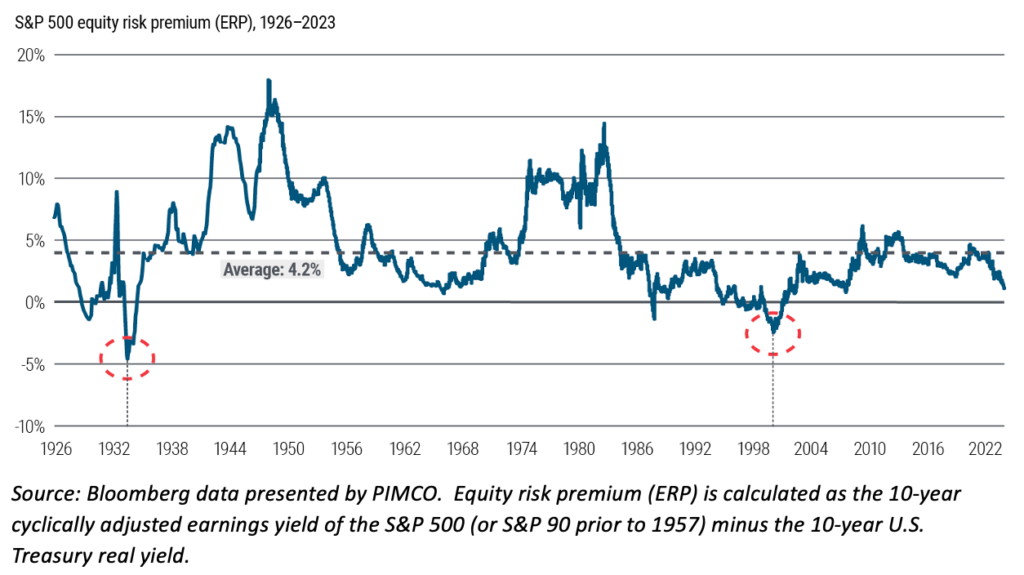

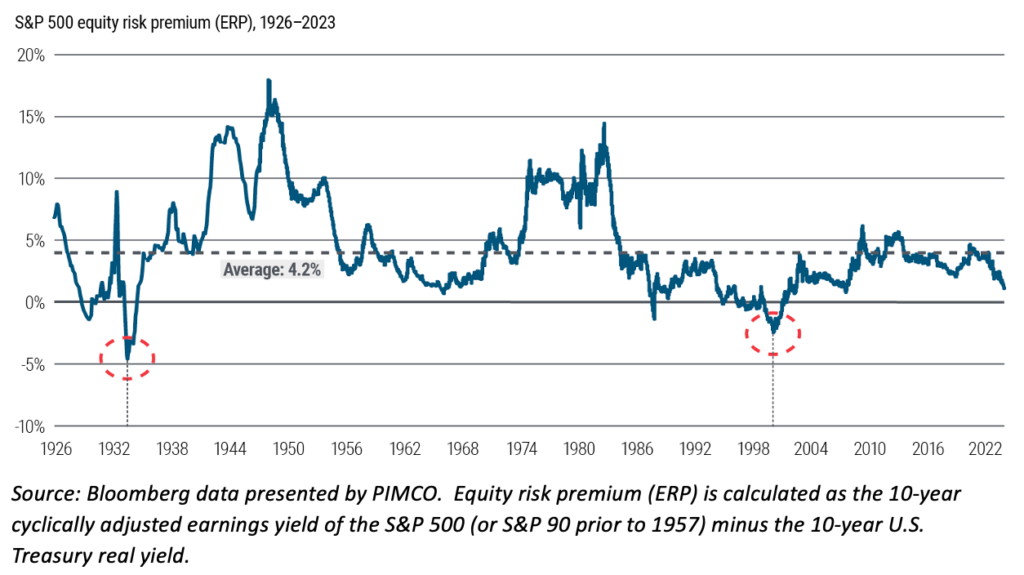

The chart below shows the “equity risk premium” which is effectively the earnings delivered by stock ownership, above the level of interest on 10-year U.S. Treasury debt. While the historical equity risk premium has been ~4%, it is currently ~1% due to higher stock prices and higher yields available on Treasuries.

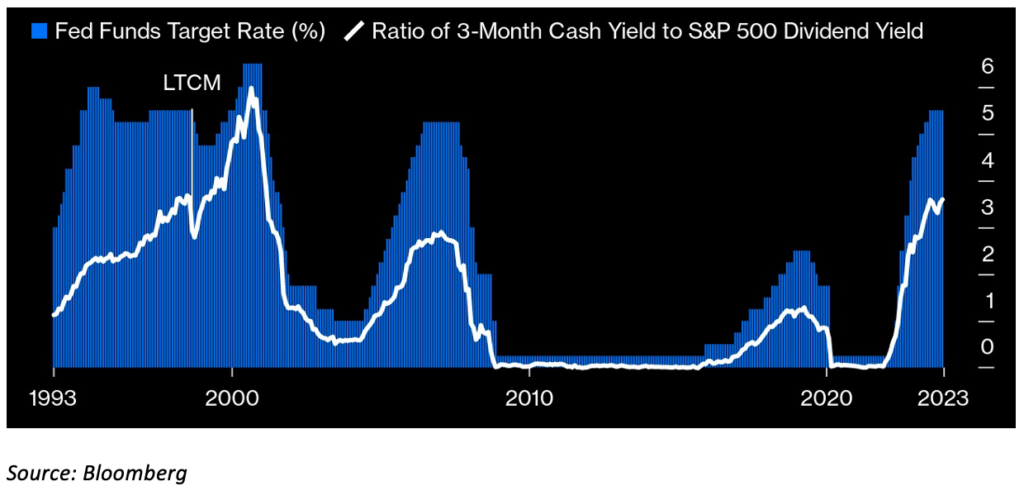

Another comparison point for stocks is to consider the ratio of the yield on short-term Treasury bills to the dividend yield of the S&P 500, which is also relatively high compared to history, as shown in the white line on the chart below. The blue bars show the short-term interest rate set by the Federal Reserve, which is also relatively high.

As markets have normalized over the years since the initial onset of the pandemic, and yields on conservative debt investments have risen to their highest levels in the past decade, we will look to balance the relative risks and opportunities in stock and bond markets by returning to our pre-pandemic target level of investment in stocks (2-4% below current targets), and generally using the proceeds to add to an existing investment, the Vanguard Intermediate-Term Treasury Fund (VFIUX).

As with all of our portfolio management efforts, we will seek to implement changes in a tax-sensitive manner. If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by Wade Financial Advisory, Inc.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments, and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors, or markets described were or will be profitable or are appropriate to meet the objectives, situation, or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor, and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment advisor registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A Copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wad Financial Advisory, Inc. at (408)369-7399 with any questions.

Portfolio Changes to Balance Market Opportunities and Risks

Neelesh Champaneri, CFA®, CAIA®

As part of our ongoing approach to systematically managing portfolio risks, we periodically seek to rebalance portfolios by bringing the mix of stocks, bonds, and alternative investments in alignment with their targets by selling a portion of higher-performing assets and purchasing those that have not performed as well.

Given the growth of the stock market, as demonstrated by the chart of the S&P 500 below, stocks now represent a slightly higher proportion of client portfolios due to the increase in value of these investments.

Additionally, to take advantage of depressed stock market prices during the peak pandemic year of 2020, we slightly increased our targeted level of stock investment at that time by 2% for conservative portfolios with a low level of stock investment and up to 4% for growth-oriented portfolios with a higher level of stock investment.

Since that time, stocks have grown slightly more expensive in comparison to bonds, as yields on U.S. Treasury investments have increased over the past several years (as yields move up, bond prices move down), as shown in the chart below.

The chart below shows the “equity risk premium” which is effectively the earnings delivered by stock ownership, above the level of interest on 10-year U.S. Treasury debt. While the historical equity risk premium has been ~4%, it is currently ~1% due to higher stock prices and higher yields available on Treasuries.

Another comparison point for stocks is to consider the ratio of the yield on short-term Treasury bills to the dividend yield of the S&P 500, which is also relatively high compared to history, as shown in the white line on the chart below. The blue bars show the short-term interest rate set by the Federal Reserve, which is also relatively high.

As markets have normalized over the years since the initial onset of the pandemic, and yields on conservative debt investments have risen to their highest levels in the past decade, we will look to balance the relative risks and opportunities in stock and bond markets by returning to our pre-pandemic target level of investment in stocks (2-4% below current targets), and generally using the proceeds to add to an existing investment, the Vanguard Intermediate-Term Treasury Fund (VFIUX).

As with all of our portfolio management efforts, we will seek to implement changes in a tax-sensitive manner. If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by Wade Financial Advisory, Inc.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments, and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors, or markets described were or will be profitable or are appropriate to meet the objectives, situation, or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor, and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment advisor registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A Copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wad Financial Advisory, Inc. at (408)369-7399 with any questions.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment adviser registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wade Financial Advisory, Inc. at (408) 369-7399 with any questions.

Categories

More Articles

Family Foundations vs. Donor-Advised Funds: Choosing the Right Vehicle for Your Philanthropy

Equity Benefits Post-IPO in Tech

Tax Benefits of Philanthropy for High-Net-Worth Individuals

2024 1st Quarter Investment Review and Portfolio Changes

High-Income Family Guide to College Financial Planning

Understanding RSUs, Stock Options, and ESPPs: Insights for Tech Executives in Silicon Valley

There's no time like the present

Contact us today to speak to one of our trusted advisors and learn how our team can partner, educate, and guide you on your path to financial confidence.