In recent weeks, stock and bond markets have been turbulent as the current and future impact of the coronavirus is being incorporated into investment markets. With our upcoming quarterly investment update, we will provide a more in-depth update on recent market events.

Market Volatility During COVID-19

As is our practice, we are monitoring portfolios to balance risks and opportunities within markets and make adjustments where appropriate. Over the course of 2020, high yield bonds shifted from paying ~3% above U.S. Treasury debt, to paying ~8% above Treasuries. While we have generally avoided higher risk bonds in recent years due to the low-interest rate premiums relative to the risk taken, the current environment has resulted in these bonds moving from prices in their most expensive quartile relative to the past 20 years, to being priced in the cheapest quartile.

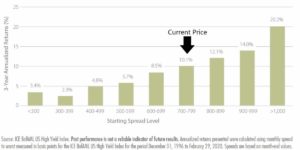

Purchasing high yield bonds at current rates has typically led to favorable outcomes when viewed from a multi-year perspective, as indicated in the chart below. To implement this change, we will transition investments from the Pimco Income fund to the Artisan High Yield fund. The change will primarily take place within bond-oriented portfolios, and for equity-oriented portfolios, we will continue to monitor equities for favorable purchase opportunities.

We welcome the opportunity to answer any questions you may have. Contact us to learn more about how WFA can partner with you to grow and protect your wealth.

Three-Year Average Annualized Returns by Starting Interest Rate Level