With the conflict in Ukraine, rising inflation, and the potential for the Federal Reserve to raise interest rates, we’d like to share our thoughts on current events with you, and discuss how they impact your investments.

Click here to skip to What It Means For Your Portfolio

In recent weeks Russian President Vladimir Putin has initiated an invasion of Ukraine to “de-militarize” the country, and to follow on to Russia’s prior military activity to take control of Crimea. The loss of life and unwarranted conflict is unsettling, and we wish for peace. Western countries have responded to the invasion by imposing severe sanctions on Russia, rather than escalating the conflict with a direct military response. Russia represents ~0.3% of the global stock market, and an even lower proportion of WFA managed portfolios.

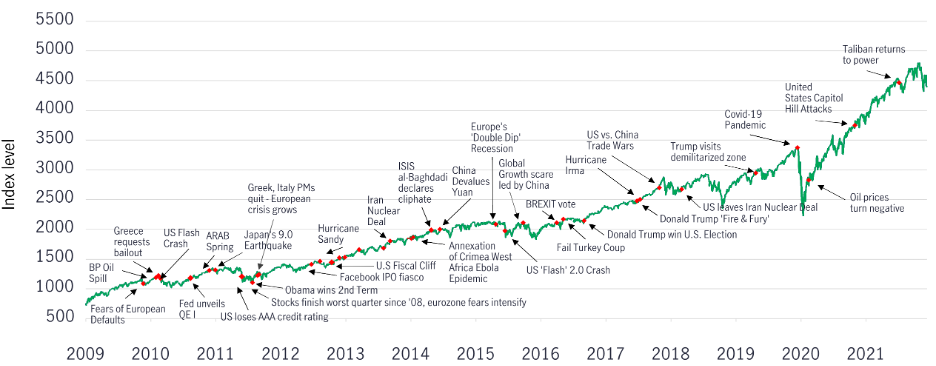

Past geopolitical events have caused quick declines in stock markets, however, these declines tend to be relatively modest in scale, and short-lived. The chart below shows the growth of the S&P 500 in the face of various geopolitical events including Russia’s past military action in Crimea, nuclear escalation with Iran and North Korea, and Britain’s vote to exit the European Union (Brexit).

Growth of the S&P 500 in the face of geopolitical events

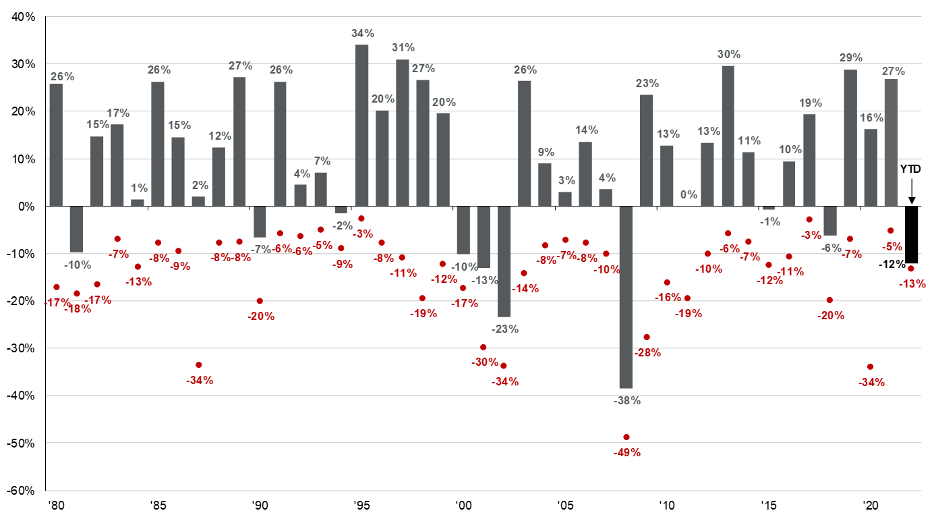

For the calendar year 2021, the S&P 500 delivered a high return (27%) with a minimal decline from peak value along the way (-5%). The steady rise of markets from April 2020 through 2021 has the potential to dim the memory of the typical declines and volatility that normally occurs in stock markets. As the chart below illustrates, annual returns (shown in grey bars) for the stock market are positive more often than not. Along the way, each year markets have some degree of decline from their peak value, and the 13% intra-year decline (shown as a red dot) for 2022 is within the range of normal outcomes experienced over several decades for stock market investors.

S&P 500 Annual Returns and Intra-Year Declines

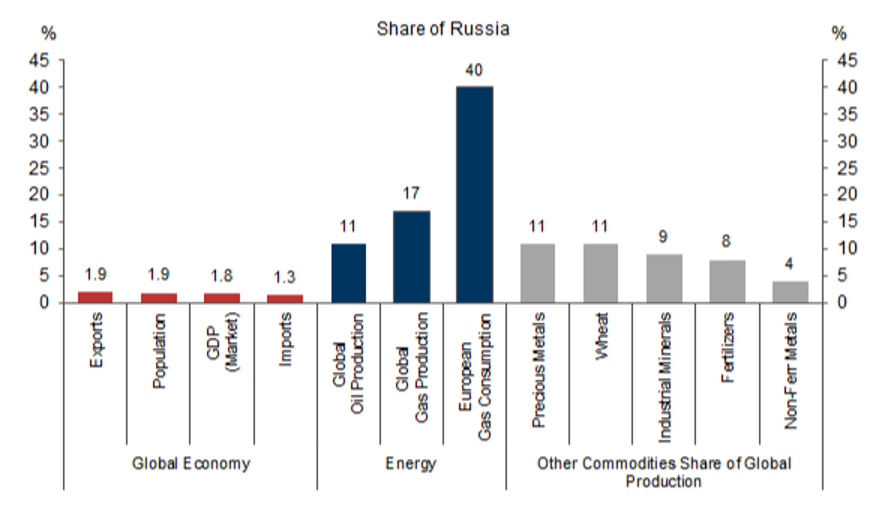

Among the sanctions imposed on Russia, the U.S. and U.K. have banned Russian oil imports, which changes the balance of supply and demand for oil, and has led to a rise in oil prices in the short-term. While Russia represents a small portion of the global economy, they produce a disproportionate amount of global energy products, especially for European consumption, as indicated by the blue bars in the chart below. To offset the change to supply, the U.S. is seeking to encourage Saudi Arabia to increase production, and help establish broader markets for Venezuelan oil.

Russia’s Role in the Global Economy

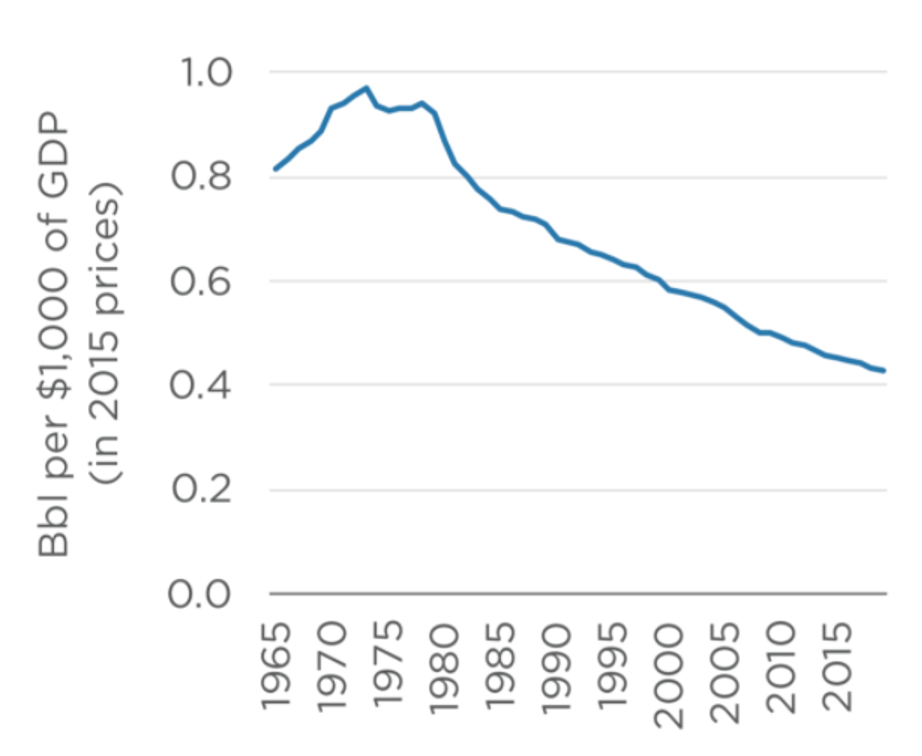

As shown below, sharp oil price spikes have historically been somewhat short-lived, as producers increase output to take advantage of higher prices, and purchasers of oil seek to reduce the amount used when prices become a constraint. At present, Europe is seeking to accelerate renewable energy projects and increase storage capacity for natural gas imported from the U.S. and other countries.

Over time, the global economy has become less reliant on oil, with a decline of over 50% in the amount of oil used per dollar of GDP generated since the 1970s peak.

Global Oil Intensity of GDP, 1965-2019

As a result of the diminishing importance of oil, and the ways in which supply and demand adjust to the price of oil, while sanctions increase the price of gasoline for consumers in the short-term, the Ukrainian conflict is not expected to be a large and persistent factor in US inflation over the long-term.

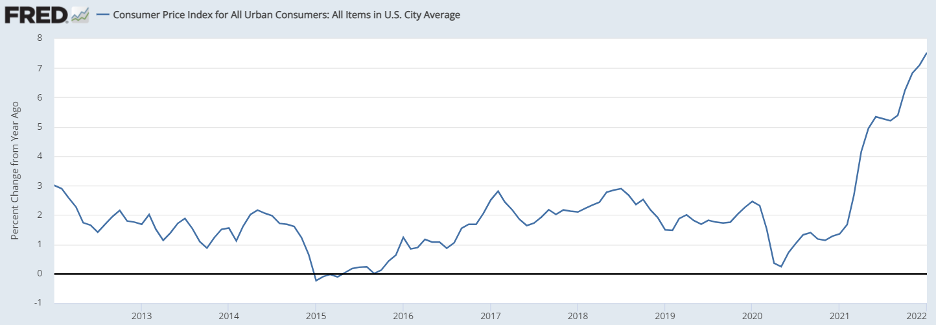

The chart below shows the annualized rate of inflation, which has been increasing relative to recent history, with year-over-year changes of ~7% in recent months.

Inflation as Measured by the Consumer Price Index

While the current inflation rate is high, it is not expected to persist, as indicated by 10-year inflation expectations. Market pricing for inflation can be inferred from the price difference between otherwise equivalent U.S. Treasury debt that is offered with or without an inflation adjustment, which is referred to as the “break-even inflation rate”. While the current reading of ~2.9% annualized inflation over the next ten years is higher than what we have experienced recently, the 1.5%-2% inflation rates of the past decade have been particularly low.

Ten Year Forward Inflation Expectations

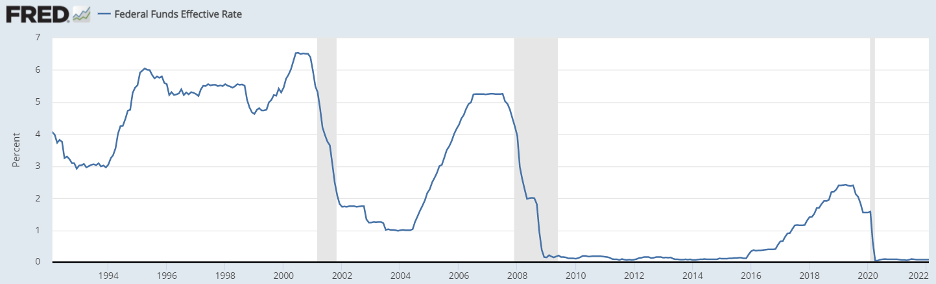

It is widely expected that the Federal Reserve, chaired by Jerome Powell, will begin raising the short-term interest rate that banks charge each other for overnight loans, known as the Federal Funds Rate. The rate has been at 0%-0.25% since the onset of the pandemic, and raising the borrowing rate is one of the tools available to moderate inflation, as a higher cost of borrowing can help curtail demand.

A challenge for the Federal Reserve will be to balance the desire to moderate inflation with the goal of maximizing employment. Considering the employment goals in combination with the uncertainty brought about by the Ukrainian conflict, the Federal Reserve may exercise greater caution in raising interest rates than anticipated previously. The chart below displays the Federal Funds Rate over the last 30 years – while we have become accustomed to very low interest rates, the economy has thrived during periods with higher rates of as much as 5%.

Historical Federal Funds Rate

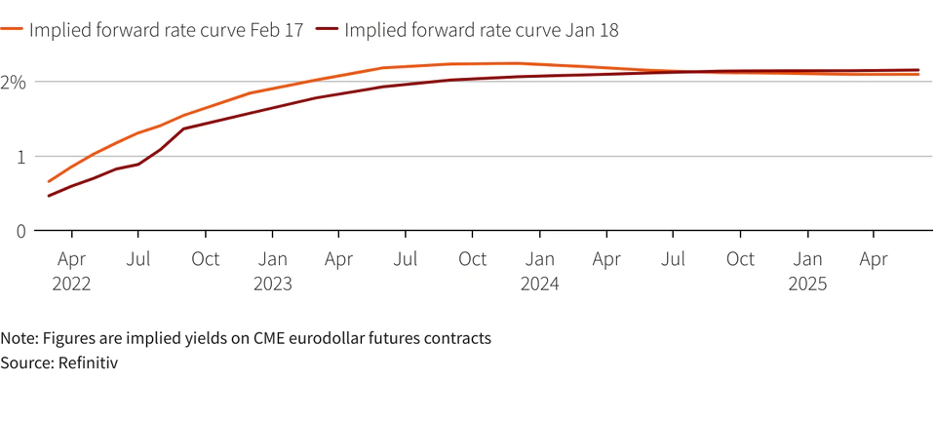

Markets also price the Federal Funds Rate into the future via contracts for short-term borrowing, and based on current market pricing, expectations are for the Federal Reserve to not raise the short-term rate above 2.5%. The chart below displays the interest rates on traded contracts for short-term borrowing in the future.

Market Pricing of Federal Funds Rate for Future Years

What It Means For Your Portfolio

- While the Ukrainian conflict is unsettling, we don’t anticipate making changes to our approach to investing in equities or changing our equity allocation targets. Geopolitical events tend to be short-term in nature, and we prefer to focus on long-term investment decisions that align with our client’s long-term investment goals. Meaningful changes to your portfolio risk should be driven by changes in your personal circumstances, rather than changes in markets.

- We seek to rebalance portfolios when declines in equity markets cause your portfolio to differ meaningfully from our targets. In taxable accounts, we seek to generate tax benefits through tax-loss harvesting (accelerating tax losses without changing the composition of your portfolio).

- We consider portfolios well-positioned for rising interest rates, and don’t perceive a current need to make changes to portfolios in response to rising interest rates and inflation, as we have been positioning portfolios to have lower sensitivity to changes in interest rates since 2019, and we expect our portfolios to have meaningfully less interest rate risk than common bond indexes, such as the Bloomberg U.S. Aggregate Bond Index.

- Investors incorporating illiquid investments such as private debt, real estate, infrastructure, farmland, and timberland, may be well-suited to withstand inflationary pressures due to the relatively higher yields of private debt, and the potential for real estate and land to increase in value in an inflationary environment.

- If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further. Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by wade Financial Advisory, Inc.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment adviser registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wade Financial Advisory, Inc. at (408) 369-7399 with any questions

At Wade Financial Advisory, our clients include successful entrepreneurs, professionals, and executives, and many of them practice philanthropy. If you’d like professional support in optimizing your charitable giving, or any other aspects of your financial plan, please reach out to us today. We currently serve clients working for companies such as Tesla, Facebook, Nvidia, Applied Materials, Apple, Microsoft Corporation, Google, Intel, Cisco Systems, Hewlett Packard, Pure Storage, Zoom Video Communications, Amazon, Adobe Inc., Palo Alto Networks and many others. We would be pleased to serve you and your family, too!