Market Summary for the 4th quarter of 2022

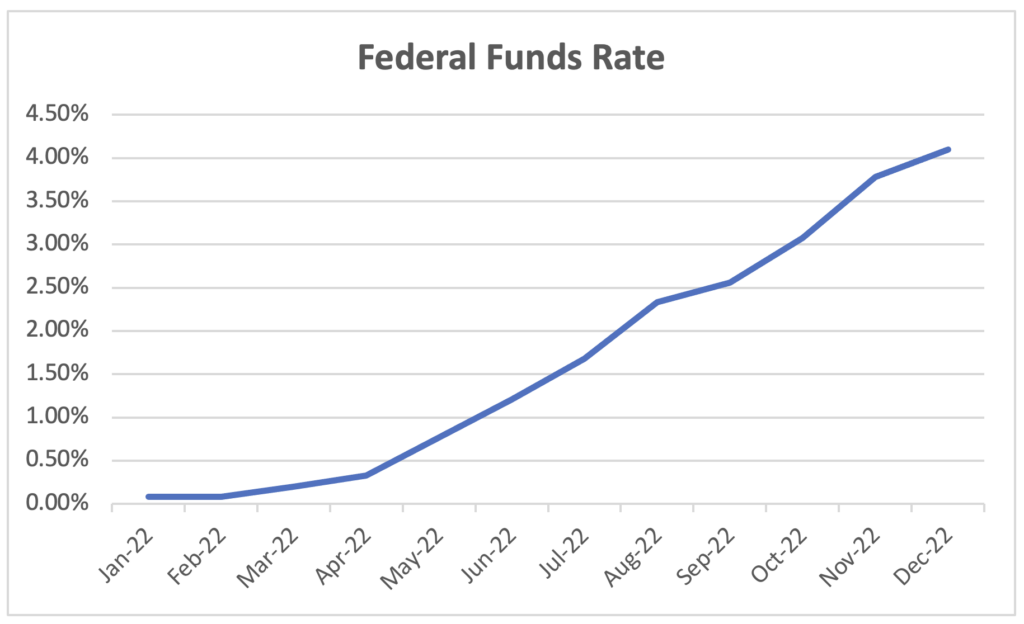

In the 4th quarter, inflationary expectations for the coming quarters moderated, positively impacting most stock and bond markets. After steadily tightening monetary policy by increasing short-term interest rates throughout 2022 (shown in the chart below), the Federal Reserve’s rate forecast suggests an end to the rate hiking campaign in 2023 as the effect of past rate increases begins to reflect in weaker inflation.

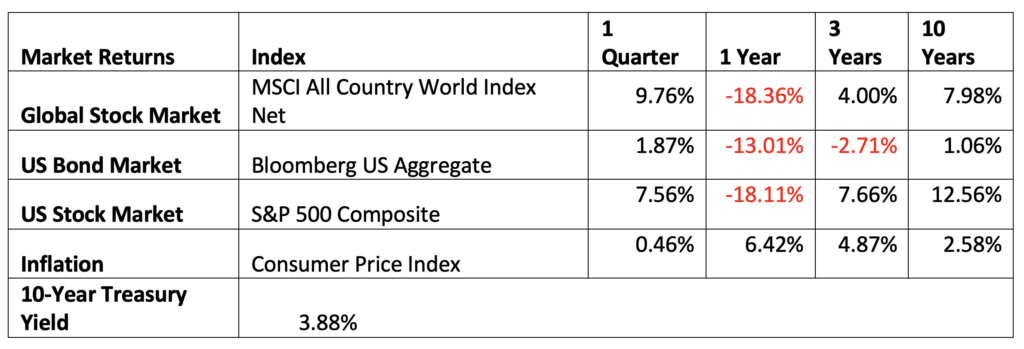

Stock prices recovered in the 4th quarter, as global equity markets increased ~10%. The S&P 500 rose by ~7%, and international developed markets benefited from foreign currencies strengthening against the dollar, resulting in a gain of ~16%. When looking at 2022 as a whole, the year still delivered negative returns for stocks, with the global stock market having declined ~18% as stock valuations declined from elevated levels at the beginning of the year, and rising interest rates reduced the prices investors were willing to pay for stocks.

The effects of stabilizing inflation expectations were also felt in the bond market in the fourth quarter, as the US bond index rose ~2%, and the global bond index rose ~5%. Yields on the bond index now exceed 4%, which provides an additional benefit to investors versus the lower yields available a year ago. Despite the recent positive quarter for the bond index, US and global bonds finished 2022 with negative returns of ~13% and ~16%, respectively.

Relative to the negative returns in both stock and bond markets, the alternative investments and private debt investments we incorporate in client portfolios generated positive returns in 2022, demonstrating their diversifying abilities.

While the potential for recession continues to linger over markets, softening inflation expectations increase the possibility that the Federal Reserve halts interest rate hikes before a recession is induced. A scenario of moderating inflation expectations, stable interest rates, and a modestly growing economy has the potential to bring optimism back to markets and continue the long-term trend of positive returns for investors in both stock and bond markets. Conversely, if inflation stays high relative to expectations, the Federal Reserve may feel forced to keep interest rates high in an effort to stifle demand, potentially weakening economic growth and driving unemployment up in the process.

The diversified and consistent approach to investing that we employ for our clients continues to align with the practices we anticipate make the most of the balance between the potential to achieve your portfolio’s long-term growth objectives and undertaking a level of risk and potential loss appropriate for your circumstances. Remaining consistent in approach and participating in markets through good times and bad continues to be a foundational principle for successful investing for the long-term.

Upcoming Portfolio Changes

Currently, our client portfolios hold either municipal debt or US bond index-like holdings as our core US public debt investments, through the use of one or more of the following:

- Vanguard California Intermediate-Term Tax-Exempt Bond Fund

- Vanguard Intermediate-Term Tax-Exempt Bond fund

- Vanguard Core Bond Fund

We will be transitioning these holdings to the Vanguard Intermediate-Term Treasury Fund, which we consider a relatively modest, but beneficial change for the reasons outlined below. As always, these transactions will be placed in tax-sensitive manner, and will only take place in accounts where we consider the tax cost to be warranted relative to the anticipated benefit to the portfolio.

At present, the US bond index consists of over 50% US government debt (such as Treasuries), with the remainder consisting of corporate and mortgage debt. While an index-like investment is relatively stable, we consider a fund of 100% US government debt to provide greater stability, and importantly, to trade at a fair price during periods of market panic. Because the US Core Bond component of our portfolios primarily serves to provide stability and a source of funds for rebalancing the portfolio when the stock market is in decline, we are transitioning to a Treasury fund to emphasize these characteristics.

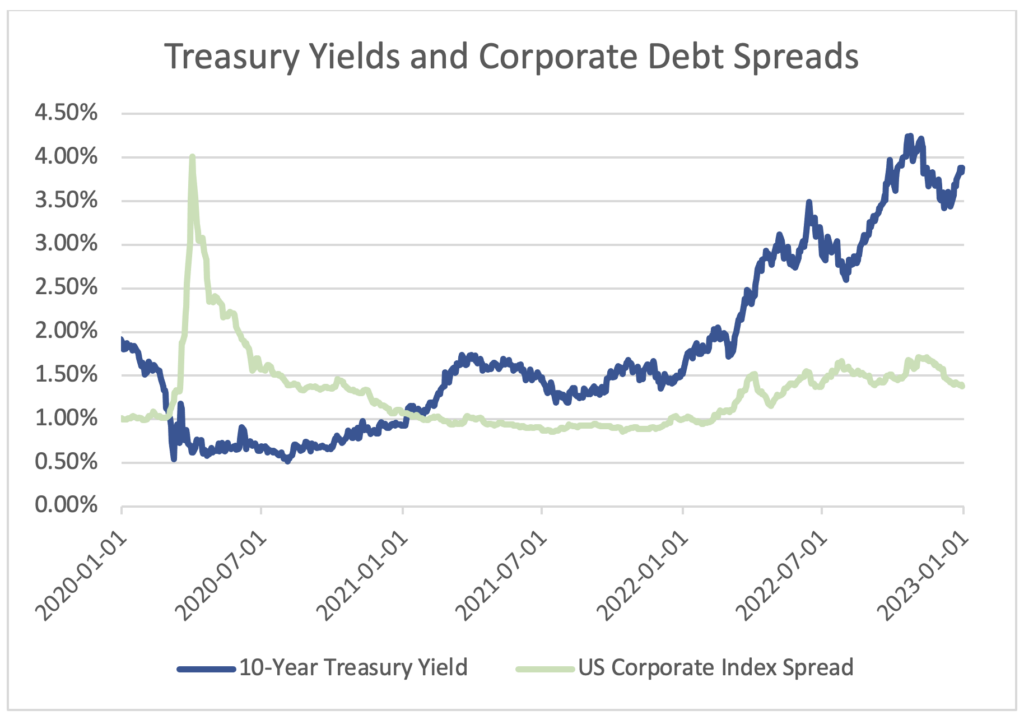

Over the past several years, interest rates have increased on Treasury investments, and our portfolios have incorporated a meaningful degree of investment in private debt holdings (where appropriate for client circumstances). These shifts in markets and portfolios have reduced our need to own publicly-traded, investment-grade corporate debt, which yields ~1.5% more than Treasuries. The chart below shows how the yield on Treasuries has moved up since the start of 2020, and the incremental compensation above Treasuries, or “spread”, for owning corporate debt has declined since the start of the pandemic, reducing the incentive to participate in this segment of corporate debt markets.

By separating our investments into discrete components for stability and rebalancing (Treasuries), and earning higher yields (private debt and higher-yielding public debt), we create the potential to fund rebalancing efforts with Treasuries alone. We consider this beneficial versus having to sell a combined investment in government and corporate debt, because when stock markets have declined meaningfully in value, corporate debt often declines as well.

Please reach out to us if you have any questions regarding this portfolio change, and we’d be glad to address them.

Market Summary for the 4th quarter of 2022

If you would like to review any aspect of your investments, or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by Wade Financial Advisory, Inc.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment adviser registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wade Financial Advisory, Inc. at (408) 369-7399 with any questions.

2022 4th Quarter Investment Review and Portfolio Changes

Neelesh Champaneri, CFA®, CAIA®

In our quarterly investment update, we’d like to:

Market Summary for the 4th quarter of 2022

In the 4th quarter, inflationary expectations for the coming quarters moderated, positively impacting most stock and bond markets. After steadily tightening monetary policy by increasing short-term interest rates throughout 2022 (shown in the chart below), the Federal Reserve’s rate forecast suggests an end to the rate hiking campaign in 2023 as the effect of past rate increases begins to reflect in weaker inflation.

Stock prices recovered in the 4th quarter, as global equity markets increased ~10%. The S&P 500 rose by ~7%, and international developed markets benefited from foreign currencies strengthening against the dollar, resulting in a gain of ~16%. When looking at 2022 as a whole, the year still delivered negative returns for stocks, with the global stock market having declined ~18% as stock valuations declined from elevated levels at the beginning of the year, and rising interest rates reduced the prices investors were willing to pay for stocks.

The effects of stabilizing inflation expectations were also felt in the bond market in the fourth quarter, as the US bond index rose ~2%, and the global bond index rose ~5%. Yields on the bond index now exceed 4%, which provides an additional benefit to investors versus the lower yields available a year ago. Despite the recent positive quarter for the bond index, US and global bonds finished 2022 with negative returns of ~13% and ~16%, respectively.

Relative to the negative returns in both stock and bond markets, the alternative investments and private debt investments we incorporate in client portfolios generated positive returns in 2022, demonstrating their diversifying abilities.

While the potential for recession continues to linger over markets, softening inflation expectations increase the possibility that the Federal Reserve halts interest rate hikes before a recession is induced. A scenario of moderating inflation expectations, stable interest rates, and a modestly growing economy has the potential to bring optimism back to markets and continue the long-term trend of positive returns for investors in both stock and bond markets. Conversely, if inflation stays high relative to expectations, the Federal Reserve may feel forced to keep interest rates high in an effort to stifle demand, potentially weakening economic growth and driving unemployment up in the process.

The diversified and consistent approach to investing that we employ for our clients continues to align with the practices we anticipate make the most of the balance between the potential to achieve your portfolio’s long-term growth objectives and undertaking a level of risk and potential loss appropriate for your circumstances. Remaining consistent in approach and participating in markets through good times and bad continues to be a foundational principle for successful investing for the long-term.

Upcoming Portfolio Changes

Currently, our client portfolios hold either municipal debt or US bond index-like holdings as our core US public debt investments, through the use of one or more of the following:

We will be transitioning these holdings to the Vanguard Intermediate-Term Treasury Fund, which we consider a relatively modest, but beneficial change for the reasons outlined below. As always, these transactions will be placed in tax-sensitive manner, and will only take place in accounts where we consider the tax cost to be warranted relative to the anticipated benefit to the portfolio.

At present, the US bond index consists of over 50% US government debt (such as Treasuries), with the remainder consisting of corporate and mortgage debt. While an index-like investment is relatively stable, we consider a fund of 100% US government debt to provide greater stability, and importantly, to trade at a fair price during periods of market panic. Because the US Core Bond component of our portfolios primarily serves to provide stability and a source of funds for rebalancing the portfolio when the stock market is in decline, we are transitioning to a Treasury fund to emphasize these characteristics.

Over the past several years, interest rates have increased on Treasury investments, and our portfolios have incorporated a meaningful degree of investment in private debt holdings (where appropriate for client circumstances). These shifts in markets and portfolios have reduced our need to own publicly-traded, investment-grade corporate debt, which yields ~1.5% more than Treasuries. The chart below shows how the yield on Treasuries has moved up since the start of 2020, and the incremental compensation above Treasuries, or “spread”, for owning corporate debt has declined since the start of the pandemic, reducing the incentive to participate in this segment of corporate debt markets.

By separating our investments into discrete components for stability and rebalancing (Treasuries), and earning higher yields (private debt and higher-yielding public debt), we create the potential to fund rebalancing efforts with Treasuries alone. We consider this beneficial versus having to sell a combined investment in government and corporate debt, because when stock markets have declined meaningfully in value, corporate debt often declines as well.

Please reach out to us if you have any questions regarding this portfolio change, and we’d be glad to address them.

Market Summary for the 4th quarter of 2022

If you would like to review any aspect of your investments, or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by Wade Financial Advisory, Inc.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment adviser registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wade Financial Advisory, Inc. at (408) 369-7399 with any questions.

This communication contains the opinions of Wade Financial Advisory, Inc. about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.

Wade Financial Advisory, Inc. is an investment adviser registered with the Securities and Exchange Commission. Registration of an Investment Advisor does not imply any level of skill or training. A copy of current Form ADV Part 2A is available upon request or at www.advisorinfo.sec.gov. Please contact Wade Financial Advisory, Inc. at (408) 369-7399 with any questions.

Categories

More Articles

Family Foundations vs. Donor-Advised Funds: Choosing the Right Vehicle for Your Philanthropy

Equity Benefits Post-IPO in Tech

Tax Benefits of Philanthropy for High-Net-Worth Individuals

2024 1st Quarter Investment Review and Portfolio Changes

High-Income Family Guide to College Financial Planning

Understanding RSUs, Stock Options, and ESPPs: Insights for Tech Executives in Silicon Valley

There's no time like the present

Contact us today to speak to one of our trusted advisors and learn how our team can partner, educate, and guide you on your path to financial confidence.