In our quarterly investment update, we’d like to:

- Summarize market activity over the 2nd quarter of 2022

- Discuss recessionary headlines and how it relates to your portfolio

- Provide various market returns information

Market Summary for the 2nd quarter of 2022

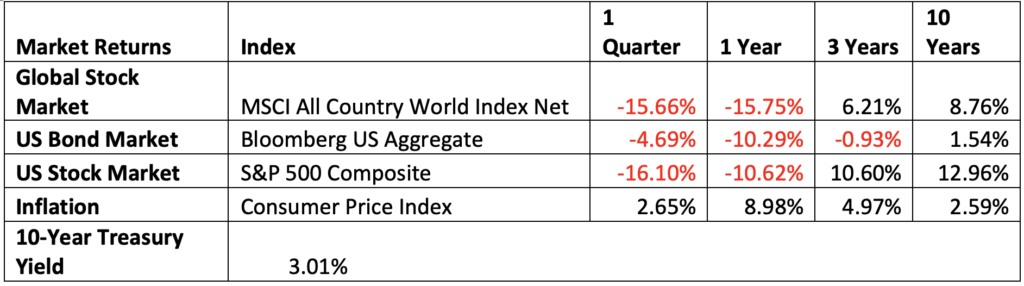

Global equity markets declined ~15% in the second quarter and entered into a bear market, characterized by a decline of 20% or more from peak values. Inflationary pressures have created concerns that the Federal Reserve may need to increase short-term interest rates above 3% to combat inflation, as raising the cost of funds for consumption and investment can discourage the growth in demand for goods and services, reducing imbalances between demand and supply that drives inflation. The potential for reduced demand dampens expectations for economic growth, while higher interest rates reduce the present value of companies’ future earnings – both of these factors contribute to declines for the stock market.

For traditional bond investments, increases in both inflation expectations and interest rates negatively impact the value of bonds, resulting in a decline in value for the Bloomberg US Aggregate Bond Index of ~4.7% for the quarter, and ~10% over four quarters.

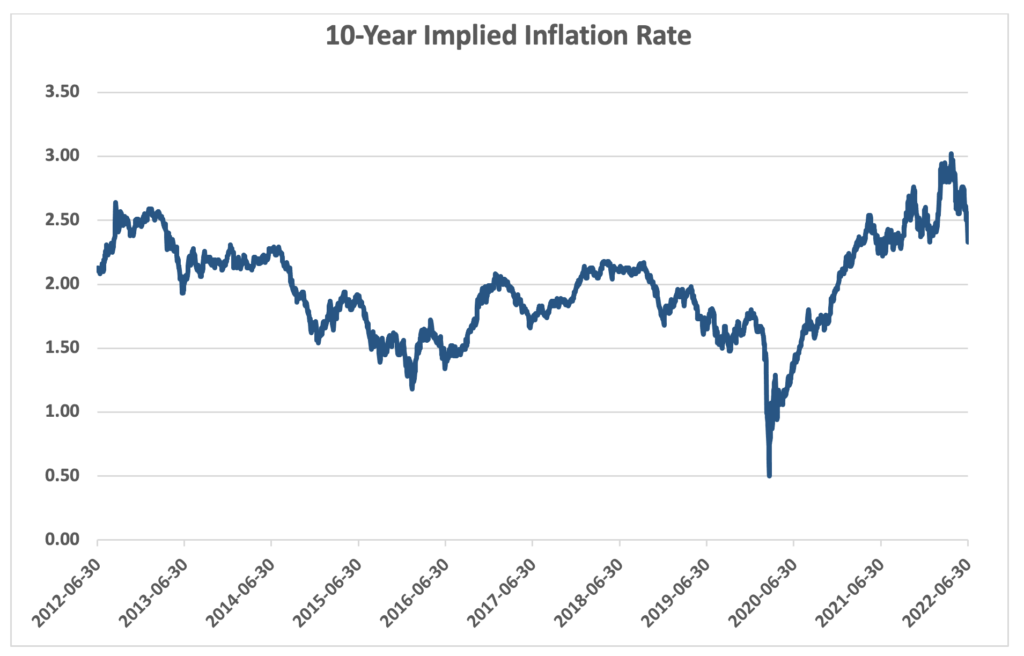

Inflation rose to 9.1% in June as measured by the Consumer Price Index, reaching a multi-decade high. While short-term inflation is at a 40-year high, market expectations for inflation over the coming decade is closer to 3% annualized, as expressed by market price differences for US Treasuries offered with and without inflation adjustments. These expectations are shown in the chart below, which indicates that long-term inflation expectations at present are consistent with the 2-3% range observed in years past.

Data Source: Federal Reserve Bank of St. Louis

The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities (BC_10YEAR) and 10-Year Treasury Inflation-Indexed Constant Maturity Securities (TC_10YEAR). The latest value implies what market participants expect inflation to be in the next 10 years, on average.

Differentiated investments including private debt and alternative investments generally had favorable performance, with the majority of strategies employed outperforming a traditional stock and bond index approach in the second quarter. We consider investments in private real estate, infrastructure assets, farmland, and timber to provide the potential to offset inflation risks within a diversified portfolio.

As client portfolios have participated in the losses experienced in broad markets, we seek to continue executing our processes to generate benefits where possible through tax-loss harvesting and rebalancing across asset classes to keep portfolios in line with their intended parameters. In practice, this generally has resulted in trimming back better performing alternative investments and private debt to purchase equities and conservative bonds. As a reminder, tax-loss harvesting is the process of selling an investment at a loss and replacing it with similar investment, for the purpose of accelerating tax benefits and deferring tax liabilities, without changing the overall characteristics of your portfolio.

Recessionary Headlines and Your Portfolio

Financial news in recent months has been dominated by talk of a potential recession, with some considering a recession a near certainty, while others dismiss the possibility outright. We don’t think it is realistic to have so much certainty in one outcome or the other, as a wide range of outcomes are possible, which is generally the case for any financial forecast.

To address the question of how a recession is defined, while it is commonly associated with two-quarters of declining GDP growth, US recessions are labeled by the NBER (National Bureau of Economic Research) Business Cycle Dating Committee, which looks for a significant decline in economic activity that is spread across the economy and lasts more than a few months. Three main criteria must be met:

- Depth – is the decline significant?

- Duration – does the decline last more than a few months?

- Diffusion – is the impact broadly felt across the economy?

Recessions can be categorized into three major groups:

- Structural recessions, like the global financial crisis of 2008-2009

- Event-driven recessions, like the pandemic recession of 2020

- Cyclical recessions, which we last experienced in 2001

While structural recessions are the most severe and long-lasting as they require significant changes to the economy to correct past errors, such as the high leverage and speculation of global financial crisis, they tend to be very infrequent as the magnitude of issues that cause them rarely occur.

Event-driven recessions, as the name implies, are caused by a single event, typically a shock to the economy, and tend to be short-lived, although impacts can be mild to severe. These are the rarest forms of recessions.

Cyclical recessions tend to be mild to moderate events and are the most common type. A cyclical recession is typically brought on by expansive elements of the economic cycle reaching an excess and then being curtailed through a naturally occurring reduction in demand or government policies to constrain demand through higher borrowing costs (monetary policy), or reduced government spending (fiscal policy) – monetary policy is the most common tool employed to reduce excess demand and inflation.

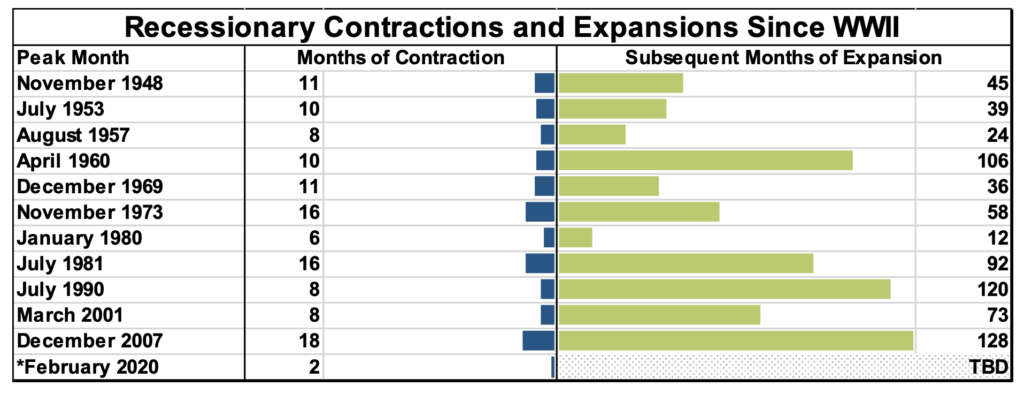

The chart below displays the length of recessions after World War II, and the much longer expansionary periods after each recession.

Data Source: National Bureau of Economic Research

While recessionary periods are meaningful, they do not perfectly align with stock market declines, as the stock market represents current expectations for future economic conditions. Stock markets typically decline in advance of a recession, and often begin their recoveries while the economy is still in the midst of a recession when peak pessimism induced by the recent past turns to optimism over initial indicators of a return to growth.

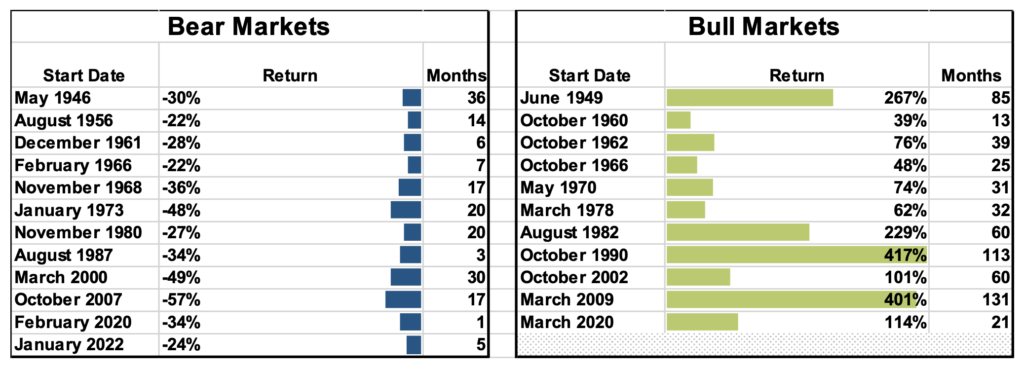

The US stock market as represented by the S&P 500 has already experienced a decline of ~24% since reaching a peak value in January, in anticipation of the possibility of a recession. If we anticipate a ~35% decline associated with moderate cyclical recessions, the market has already priced in much of the potential loss. We don’t consider it appropriate to make big changes to the level of stock investment in response to a market decline, as these types of market timing decisions create the risk of missing out on future stock market gains.

Data Source: FactSet, NBER, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management.

A bear market is defined as a 20% or more decline from the previous market high. The related market return is the peak to trough return over the cycle. Bear and bull returns are price returns.

Your portfolio is designed with consideration for both good and poor markets, and with thought given to the impact of interest rates, inflation, recessionary risk, and the general growth that economies and stock markets tend to enjoy over longer time periods. While it can be uncomfortable to see your portfolio decline in value, we consider participating in losses to be the necessary price of enjoying the long-term gains of stock market investment.

In recent years, we have made adjustments to reduce portfolios’ negative impacts from rising interest rates. For clients that utilize illiquid investments, we have added investments such as private real estate and real assets that can benefit from an inflationary environment, balancing the risks to the portfolio overall.

Within stock investments, one component of our approach is the use of “quality” stock investments through ETFs which emphasize companies with high-profit margins, stable earnings growth and lower debt levels than their peers. While these investments will lose value in a recession and in the current bear market, they have the potential to modestly outperform the market if profitability and the cost of debt become greater challenges for the stock market as a whole.

While your portfolio has not dramatically shifted in composition, we consider your portfolio to be well-positioned to participate in long-term growth while diversifying and moderating the risks it is exposed to. We will continue to monitor the investments used within your portfolio and perform the tax-loss harvesting and rebalancing activities that we anticipate can generate meaningful value during a downturn.

Market Summary for the 2nd quarter of 2022

Returns as of 6/30/2022, for trailing periods. Returns for periods over one year are annualized.

If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by Wade Financial Advisory, Inc.