In our quarterly investment update, we’d like to:

- Summarize market activity over the 2nd quarter of 2021

- Discuss portfolio changes to incorporate additional private debt investments

- Provide various market returns information

Market Summary for the 2nd quarter of 2021

Global equity markets advanced ~7% in the second quarter as economies continue to recover from the peak economic impact of the pandemic. The Labor Department reported a record number of job openings and declining jobless claims for the quarter. As an increase in infection rates raised concern about the future pace of reopening, the largest and most profitable businesses fared the best in stock markets relative to economically sensitive companies that often trade at a discount. International equity markets participated in the stock market rally with ~6% growth, as vaccination availability advanced in developed countries, particularly in Europe.

U.S. bond markets performed well in the quarter as foreign demand for Treasuries brought yields on the 10-year Treasury note to their lowest point since March of 2020, finishing the quarter at 1.45%. Municipal bonds fared well as the growth in economic activity, federal spending plans, and potential tax increases drove a greater investor appetite for tax-exempt bonds issued by state and local governments that are on sounder financial footing than a year ago.

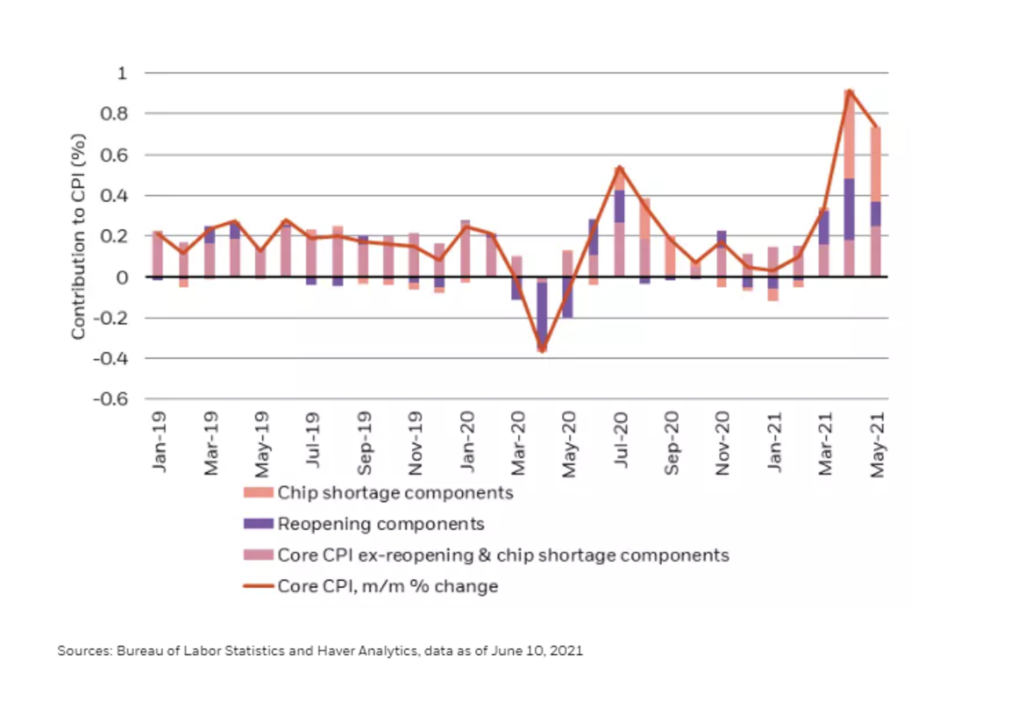

Relative to the ~2% inflation experienced over the last decade, recent inflation measures have been higher, at ~5% as measured by the Consumer Price Index. While this number is large, there is good reason to not extrapolate that rate of inflation into the far future. Prices relative to the prior year show high percentage increases largely because the prices of many goods and services fell sharply in the initial months of the pandemic, and now become the comparison point for price levels.

Certain goods also experienced pandemic-driven supply constraints such as semiconductors and lumber, with the associated costs flowing through to the consumer products that need these inputs. As production capacity is brought back for temporarily constrained semiconductor facilities, sawmills, and other goods, we may have good reason to expect inflation to come closer to the long-term average of ~2%, as illustrated by the breakdown of inflation drivers shown below.

As we look ahead, we anticipate the long-term benefits of investing in a diversified portfolio at an appropriate level of risk provides the potential to generate returns in excess of inflation, and help achieve our clients’ goals. We acknowledge that matters including rising coronavirus cases, changes to fiscal and tax policy, and increasing valuations in stock and bond markets contribute to near-term uncertainty.

For long-term investors, we anticipate that the economic impact of the pandemic will diminish in the years ahead, particularly as vaccine availability increases globally. While changes in political leadership often drive conversations around policy changes, the laws that eventually pass are often the product of compromise and less onerous than initial proposals. As stock prices rise, we anticipate earnings will continue to grow over time and provide support for higher prices, as has been the case when looking at longer periods of stock market history. For bond investors, we position portfolios to have relatively greater ownership of debt investments with favorable yields or lower sensitivity to interest rates, which we anticipate will moderate the susceptibility to rising interest rates and modestly higher inflation.

Portfolio Changes to Incorporate Additional Private Debt Investments

As part of our continuous process to evaluate investment opportunities and existing investments within portfolios we are incorporating a new investment, the Cliffwater Corporate Lending Fund, for clients utilizing illiquid interval fund investments (which are investments that cannot be bought or sold on a daily basis but offer quarterly redemption opportunities). The Cliffwater fund holds a portfolio of over $2 billion of loans made to thousands of privately held businesses, typically with earnings in the range of ~$75M, across a wide variety of industries. Sample borrowers within the portfolio are DoorDash and TopGolf, which are larger, better-known businesses than the average borrower, which would be represented by everyday firms such as Marquee Dental, a network of Southeastern dental practices, or Fleetwash, a semi-truck and trailer cleaning business. As yields on public high-yield bonds have declined from the very favorable rates available a year ago, and yields on conservative bonds remain in the 1-2% range, we find private debt investments, and the Cliffwater fund specifically, attractive for several reasons detailed below.

-

Relatively Higher Yields

As we have experienced with our other private debt investment, the Variant Alternative Income Fund, private debt funds have the potential to provide yields above public markets. At present, the Cliffwater fund provides a yield of ~7%, while publicly traded high yield bonds yield ~4%, and high quality corporate bonds yield ~2%. Private debt can offer a higher yield for several reasons:

- Borrowers are smaller than large well-known corporations that can issue billions of dollars of bonds in public markets at low rates.

- Loans can typically be arranged in under two months, versus a longer and more expensive process of issuing public debt, and borrowers are generally willing to pay a premium for faster funding.

- Investors require a yield premium for owning debt that is not publicly traded

-

Floating Rate Loans

While most bond investments offer fixed payments, corporate loans are generally issued on a floating rate basis (also referred to as a variable rate), which allows investors to benefit in the event of rising interest rates, as changes in interest rates are passed on the borrower. For a bond with fixed payments, rising interest rates can diminish the value of an existing bond.

-

Greater Participation In A Diversifying Asset Class

Within private debt markets, investors in the Variant Alternative Income fund already participate in a broad array of diversifying debt investments (primarily within the “enhanced” categories shown on the left below). Adding the Cliffwater fund to our portfolios allows us to complement our existing private debt investments with participation in the corporate direct lending market, which is one of the largest and most established segments of private debt.

1 For illustrative purposes only. The chart only is intended to identify the subsectors within the Private Credit opportunity set.

-

Attractive Cost Structure

As with all of our investments, we are focused on ensuring that we utilize cost-effective and competitively priced holdings. With the Cliffwater fund, we have selected a partner that primarily works with endowments and pension funds, and offers their fund at attractive prices to organizations like WFA that can satisfy the $10 million minimum investment and then make the fund available to clients in amounts appropriate for their portfolio.

Due to the institutional nature of the Cliffwater organization, we are able to access and pass on substantial cost savings to our clients by investing in the Cliffwater Corporate Lending Fund (CCLFX), relative to the methods typically used by investors to access private loans: Publicly traded business development corporations (BDCs), and private funds which are generally structured as limited partnerships and charge both asset-based fees and performance fees. The Cliffwater fund avoids performance-based fees and is available at a low fee level for the asset class as illustrated below.

Fees shown include management fees, administrative fees, and performance or incentive fees.

For clients utilizing illiquid investments, the Cliffwater purchase will be funded by lowering our intended level of investment in conservative US bonds, publicly-traded high-yield bonds, and global bonds. Our overall intended level of bond investments will remain unchanged.

Market Summary for the 2nd quarter of 2021

| Market Returns | Index | 1 Quarter | 1 Year | 3 Years | 10 Years |

| Global Stock Market | MSCI All Country World Index Net | 7.39% | 39.27% | 14.56% | 9.90% |

| US Bond Market | Bloomberg Barclays US Aggregate | 1.83% | -0.33% | 5.34% | 3.39% |

| US Stock Market | S&P 500 Composite | 8.55% | 40.79% | 18.67% | 14.84% |

| Inflation | Consumer Price Index | 2.34% | 5.35% | 2.60% | 1.88% |

| 10-Year Treasury Yield | 1.45% | ||||

| Returns as of 6/30/2021, for trailing periods. Returns for periods over one year are annualized. | |||||

If you would like to review any aspect of your investments or have any questions regarding this message, please contact us and we would be glad to discuss further.

Thank you,

The Wade Financial Advisory, Inc. Team

**Portfolio commentary pertains only to portfolios directly managed by Wade Financial Advisory, Inc. Please reach out to us if you would like to discuss a change in management of any portfolio not directly managed by Wade Financial Advisory, Inc.**